NDPHIT provides our Employee Benefits (Health, Dental and Vision)

(North Dakota Public Health Insurance Trust)

Employee Benefit Info

Next Open Enrollment will be November 27th-December 1st (for 2024 benefits). If you have a "qualifying event" at any time during the year, please contact Krista.

Current Benefits thru Dec 31, 2023

Benefits Guide 2024 - NDPHIT

Watch this video regarding benefits:

https://www.brainshark.com/hayscompanies/vu?pi=zHXz19I3n2zSNrqz0

Employee Benefits

Benefit Period: January 1, 2024 thru Dec 31, 2024

Next Open Enrollment: November 27 - December 1, 2023

Questions? Contact Krista Martin by email kmartin@gfkairport.com or call ext. 437

REQUIRED: Schedule a time to review your Benefits.

- You will be required to Schedule a Meeting with Krista in November 27th thru December 1st, 2023.

- During your meeting, all benefits will be discussed. December 8th will be the last day to finalize benefits with Krista as you may need to discuss with family members after initial meeting. (You can finalize via email / phone if you have had your initial meeting)

Review: Please take a few minutes to review all benefits available. They can/ will be discussed during your meeting.

Times for Benefit Meeting- Need to call Krista to schedule (ext 647)

Please see email from Krista Martin for times that are available.

Please follow the instructions in the link below to register on the BCBS Member Portal.

You will be able to view all your visits, charges and see how deductibles and co pays are applied.

• Health Insurance Terms - Know Your Benefits

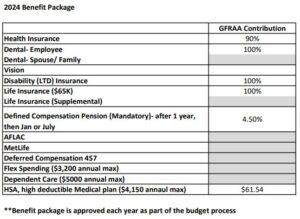

• Benefits Package - January 1, 2024- December 31, 2024

Rates

• YourBlue 80 800 - $800/$1,200/$1,600 Low Deductible Health Plan with FSA option

• BlueSaver 80 3200 - $3,200/$4,800/$6,400 High Deductible health plan with $61.54 per month HSA included

- EE: Employee / ES: Employee & Spouse / EC: Employee & Children / Family: All family members

| BCBSND NDPHIT BlueSaver 3200 HDHP | Bi-Weekly, Block Last | Total Monthly Premium | Employee Monthly | Employer Monthly |

| Employee | $28.92 | $578.44 | $57.84 | $520.60 |

| Employee+Spouse | $78.09 | $1,561.79 | $156.18 | $1,405.61 |

| Employee +Child | $54.95 | $1,099.03 | $109.90 | $989.13 |

| Employee+Children | $54.95 | $1,099.03 | $109.90 | $989.13 |

| Employee+Family | $104.12 | $2,082.39 | $208.24 | $1,874.15 |

| BCBSND NDPHIT New Copay RPM Plan 800 | Bi-Weekly, Block Last | Total Monthly Premium | Employee Monthly | Employer Monthly |

| Employee | $30.88 | $617.65 | $61.77 | $555.89 |

| Employee+Spouse | $83.38 | $1,667.67 | $166.77 | $1,500.90 |

| Employee +Child | $58.68 | $1,173.54 | $117.35 | $1,056.19 |

| Employee+Children | $58.68 | $1,173.54 | $117.35 | $1,056.19 |

| Employee+Family | $111.18 | $2,223.56 | $222.36 | $2,001.20 |

• Pediatric Dental and Vision - Not Covered under Medical Plans

Health Plan Detailed Information

• $800 Low Deductible NDPHIT YourBlue 80 800 Summary of Benefits

- The FSA is available with this plan (not required). Annual maximum is $3,200.

• $3,200 High Deductible NDPHIT BlueSaver HDHP 80 3200 Summary of Benefits

- The HSA is available with this plan and GFRAA contributes $61.54 per pay period. You have to option to contribute additional, but not required. Annual maximum is $4,150.

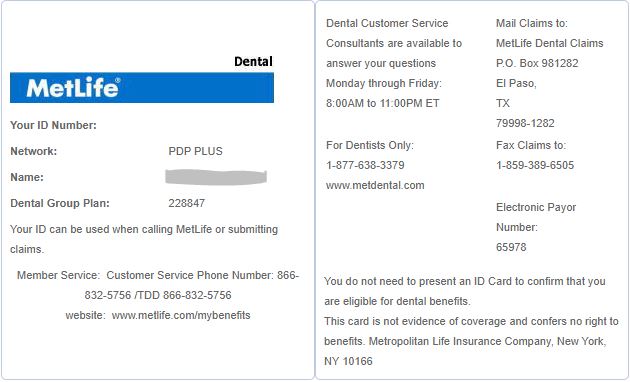

We encourage all members to register online to have direct access to their MetLife products!

Once registered, you can review claims, file claims and see claims processed.

Dental Plan Summary and Rates- 2 Options are Offered (High and Low Plan)- Comparison is below with costs

- GFRAA pays for the employees premium.

- Employee can add spouse/family for additional premium.

- Employee and spouse/ family need to be on the same plan

- If it's just the employee on the policy, the airport will pay for the High Plan.

- Who are the providers with Met Life? https://www.metlife.com/insurance/dental-insurance/

- Our Network is PDP Plus

- This website does not reflect all the in-network providers so when you contact a provider- ask them if they accept MetLife as In-Network.

- Even if they are out- of Network, the Met Life dental plan pays the 90th Percentile fee schedule to out of network dentists which is generally more than the average billed charges of all dentists in North Dakota

- The Annual maximum is Per Person

- Pediatric Dental and Vision (Please note that children WILL NOT be covered under your Health Insurance)

**The Employee and Family need to be on the same plan.

COVERAGES:

| DENTAL PLAN | HIGH PLAN | LOW PLAN | |

| (In-Network) | (In-Network) | ||

| Deductible | |||

| Individual | $50 | $50 | |

| Family | $150 | $150 | |

| Calendar Year Maximum | $1,250 | $1,000 | |

| What the Plan Covers | |||

| Preventive Care | 100% Covered | 80% Covered | |

| Basic Services | 80% AD | 70% AD | |

| Endodontics, periodontics, oral surgery | 80% AD | 70% AD | |

| Major Services | 50% AD | 50% AD | |

| Orthodontia (child up to 19) | 50% AD | Not covered | |

| Orthodontia Lifetime Maximum | $1,250 | Not covered | |

RATES:

| MetLife Dental Low Plan | Monthly - First | Total Monthly Premium | Employee Monthly | Employer Monthly |

| Employee | $0.00 | $34.50 | $0.00 | $34.50 |

| Employee+Spouse | $34.39 | $68.89 | $34.39 | $34.50 |

| Employee +Child | $35.27 | $69.77 | $35.27 | $34.50 |

| Employee+Children | $35.27 | $69.77 | $35.27 | $34.50 |

| Employee+Family | $76.20 | $110.70 | $76.20 | $34.50 |

| MetLife Dental High Plan | Monthly - First | Total Monthly Premium | Employee Monthly | Employer Monthly |

| Employee | $0.00 | $42.24 | $0.00 | $42.24 |

| Employee+Spouse | $41.98 | $84.22 | $41.98 | $42.24 |

| Employee +Child | $52.16 | $94.40 | $52.16 | $42.24 |

| Employee+Children | $52.16 | $94.40 | $52.16 | $42.24 |

| Employee+Family | $103.81 | $146.05 | $103.81 | $42.24 |

**Costs reflected above are what the EMPLOYEE WILL PAY PER MONTH.

MetLife Vision: 100% paid by employee, but not required

Where can I find an In Network Vision Provider:

- https://mymetlifevision.com/find-provider-location-internal.html

- This website does not reflect all the in-network providers so when you contact a provider- ask them if they accept MetLife as In-Network.

- Once you have a prescription, you can find many other in-network providers that are not located at your Vision Center (ex: EyeMart Express)

- If you have a child under the age of 19, the Pediatric Dental/ Vision are NOT included with your HEALTH insurance plan- you will need to cover children under Vision.

COVERAGES:

| VISION PLAN | YOU PAY | YOU PAY |

| (In-Network) | (Out-of-Network) | |

| Eye Exams (once every 12 months) | $10 copay | $45 allowance |

| Lenses (once every 12 months) | ||

| Single Vision | $10 copay | $30 allowance |

| Bifocal | $10 copay | $50 allowance |

| Trifocal | $10 copay | $65 allowance |

| Lenticular | $10 copay | $100 allowance |

| Frames (once every 24 months) | $70 allowance | |

| Any frame at provider location | $150 allowance | |

| Featured frame brands | $150 allowance | |

| Walmart/Sam’s Club/Costco | $85 allowance | |

| Additional Cost | 20% savings on add’l amounts | |

| Contact Lenses (once every 12 months) | ||

| Contact Fitting/Evaluation | $60 copay | Applied to lens allowance |

| Elective Conventional/Disposable Contacts | $150 allowance | $105 allowance |

| Medically Necessary | $10 copay | Up to $210 |

RATES:

| MetLife Voluntary Vision | Monthly - First | Total Monthly Premium | Employee Monthly | Employer Monthly |

| Employee | $7.78 | $7.78 | $7.78 | $0.00 |

| Employee+Spouse | $15.59 | $15.59 | $15.59 | $0.00 |

| Employee +Child | $13.20 | $13.20 | $13.20 | $0.00 |

| Employee+Children | $13.20 | $13.20 | $13.20 | $0.00 |

| Employee+Family | $21.76 | $21.76 | $21.76 | $0.00 |

HSA is for High Deductible Plan Only

GFRAA contributes $61.54 per pay period towards the HSA account. (This will amount to $1600 per year, which is 50% of the deductible) Employee can choose to contribute additional dollars, but not required. (Contact Krista if you would like to contribute extra to your HSA).

• HSA - Employee Handout

• HSA - Employee Guide

• HSA - The Triple Tax Advantage

• HSA - HSA Form

•• HSA Benefits Debit Card Handout

FSA is for Low Deductible Plan Only (not required to participate)

• FSA - Employee Handout

• FSA - Employee Guide

• FSA - FSA Form

MOBILE APPLICATION FOR HSA and FSA

• Mobile Application Information

COBRA- if you leave employment with GFRAA

• COBRA - We've Got You Covered

These services are 100% voluntary and 100% paid by the employee.

Met Life services are listed in detail (see other menu options)

If you have AFLAC, I would encourage you to compare the products to AFLAC and even reach out to Ann Fontaine at AFLAC with questions. (contact info is below)

AFLAC is our current provider for additional services.

MET LIFE product details are offered (see other menu options)

How can you make changes to AFLAC policy?

You will need to contact Ann Fontaine on your own. AFLAC will be on site during Open Enrollment.

Can you cancel AFLAC and switch to Met Life effective Jan 1, 2024?

YES. During Open Enrollment are you are to add/ drop or change any benefits.

Can you review your AFLAC policy and make changes to it, effective Jan 1, 2024?

YES. This will be considered Open Enrollment, and you will have the option to CANCEL , CHANGE or ADD benefits

Can you continue your AFLAC and not choose Met Life?

YES. If you continue with AFLAC your policy will be in effect the entire you.

Can you have AFLAC and Met Life?

YES, the premium is 100% paid by the employee.

You are invited to reach out to Ann Fontaine at AFLAC is you have questions between your current AFLAC policy and Met Life.

Local Claims, contact Ann Fontaine

Ann Fontaine

Benefits Consultant

701-203-3669 Cell

2750 Gateway Drive Ste D

Grand Forks, ND 58203

Register for AFLAC

Go to aflac.com/mypolicy

Click Register Now

Enter policy number and click Submit

Complete Registration form and click Submit

Verify your email

Click Agree to user agreement

You can register for any of these products during New Hire or Open Enrollment.

The policies are effective and in force until Jan 1st of the next year. (Open Enrollment in November/December of each year allows you to make changes)

Accident_Product-Overview-24-hour-coverage_NDPHIT

- High Plan Details228847- NDPHI - (GCERT16-AX - AX Plan 1 - 01-01-21)

- 228847- NDPHI - (GCERT16-AX - AX Plan 2 - 01-01-21)

Critical-Illness_Attained-Age-FAQ_NDPHIT

Critical-Illness_Attained-Age-Product-Overview_NDPHIT

Critical-Illness_Infographic-Flyer_NDPHIT

Claim forms are shown below for you to print, complete and send in.

However, we highly encourage members to register on the Metlife MyBenefits website. If you do, you will be able to use that to site pull forms, submit claims, check claim status etc.

If you have any questions, need additional information or assistance do not hesitate to contact Human Resources

Hospital Indemnity Claim Form.

Short Term Disability Claim packet. Forms.

457 Savings Plan: Not required for employees, but if you are looking to contribute additional pre-tax dollars to a retirement/savings plan, this is an option for you.

Benefits are that you can change your contributions every quarter. (GFRAA provides no matching dollars)

• Authorization for 457 Contributions

| Steve Mahn Retirement Specialist Nationwide Retirement Solutions 720-749-9101 720-749-9101 |

Met Life is provider and you will need to meet with Benefit Counselor on the phone to start the process.

See the benefit guide for rates please!

If you have additional insurance thru Standard Life you do not need to do anything as your Standard Life insurance will stay in effect thru Dec 31, 2024.

You have the option to add additional insurance thru Met Life

You also have the option to add Met Life and then ask Krista to remove the Standard Life.

Standard Life Info (GFK pays the Employees $65K policy- Life/ AD&D)

• EOI (Evidence of Insurability

• Standard Life Enrollment Change Form

Questions? Contact Krista

• Verizon Discounts - here you can sign up for discount, remember to use your @gfkairport.com email address

- Our current discount is 18%, once you complete the registration and upload a copy of your paystub.

Info on how to register and all steps involved for FIRST REPONDER

- We do receive the Emergency Responder discount.

If you are NOT a first responder, you can still get an 18-25% Corporate Discount

https://www.verizon.com/ryl/auth/rylHome